FreeTaxUSA Reviews ❤️

Hello friends, today we will discuss FreeTaxUSA reviews. In our complete and clear review, we will look at everything you need to know about FreeTaxUSA, including features, costs, advantages, disadvantages, and user experience.This review is specifically designed for you, regardless of your level of tax season experience.

FreeTaxUSA: What is it?

Since 2001, FreeTaxUSA, an IRS-approved e-file company, has assisted millions of Americans with filing their federal taxes. A Utah-based business called TaxHawk, Inc. created it. Along with a range of premium services that are still substantially less expensive than those of the majority of competitors, such as Turbo Tax or H&R Block, the platform is well-known for providing free federal tax filing and inexpensive state returns.

Important Aspects of FreeTaxUSA

- Free Federal Tax Filing: Your return is free regardless of how complex it is, including dependents, retirement income, and itemized deductions.

- Low-Cost State Returns: It just costs $14.99 to file your state taxes.

- Deluxe Upgrade ($7.99): Offers audit support, revised returns, and priority customer service.

- Accuracy Guarantee: The business promises calculations that are 100% correct.

- Audit Support: If you want to upgrade to the Deluxe version, you can get optional and reasonably priced audit assistance.

- Previous Year Import: If you have previously filed with them, you can import data from the previous year with ease.

- Secure Filing: Your data is protected by cutting-edge encryption technology.

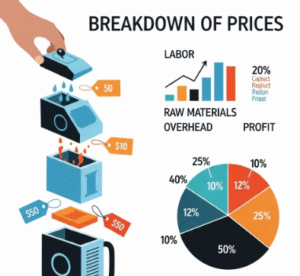

Breakdown of Prices

One of the most affordable tax filing options available is offered by FreeTaxUSA. No matter how complicated your return is, filing federal taxes is totally free. The charge is $14.99 per state for individuals who must file a state return, which is far less expensive than many of its rivals. The $7.99 Deluxe premium is available to those who want more services including audit help, priority customer support, and the opportunity to file amended returns. Furthermore, the Deluxe edition includes modified refunds and free account recovery. In contrast to other platforms that charge between $60 and $120 for comparable services, FreeTaxUSA offers outstanding value with no additional costs.

Advantages of FreeTaxUSA

- Free Federal Filing, Really FreeTaxUSA keeps its word, unlike other platforms that advertise themselves as “free” but charge for typical forms.

- Low-Cost State Filing: Much less expensive than rivals, at $14.99 per state.

- Supports Every Tax Circumstance You can file without incurring additional fees if you are self-employed, own rental property, or have capital gains.

- Quick and Simple to Use: The user interface is straightforward and walks you through each step.

- Time is saved throughout the filing process by importing prior returns.

- Secure and IRS-approved Excellent security and high trust for private information.

The drawbacks of FreeTaxUSA

- No Live Chat or Phone Support (Free Version): Assistance is only available by email unless you purchase Deluxe.

- Simple Interface: Not as cutting edge or intuitive as Turbo Tax.

- No mobile application: FreeTaxUSA lacks a mobile filing app, in contrast to other platforms.

- Limited Audit Help: This is an up sell that is only available with Deluxe.

👤 For whom is FreeTaxUSA appropriate?

The best uses for FreeTaxUSA are:

- families and individuals trying to cut costs.

- Self-employed individuals or freelancers who must file complicated taxes at a reasonable cost.

- Anyone who feels at ease filing taxes on their own.

- users who don’t want sophisticated user interfaces or a lot of customer service.

What Actual Users Have to Say

- “I’ve been using FreeTaxUSA for the past five years. I can submit federal taxes quickly, easily, and for free. — Mark T.

- “I saved more than $100 by switching from TurboTax. I will never return. — Samantha K.

- “I wish they had a mobile app, but it’s the best deal on quality and price.” — Jason D.

Final Judgment

One of the best-kept secrets in the internet tax filing space is FreeTaxUSA. It offers an unbeatable combination of precision, cost, and simplicity. It offers all most taxpayers want and more for a fraction of the price of the major names, even though it might not have all the bells and whistles.This can be the ideal option for you this tax season if you want to save a lot of money and are comfortable doing your own tax return.

10 FAQ’s

- FreeTaxUSA: Is it truly free?

For filing federal taxes, yes. - What is the cost of state filing?

$14.99 for each state. - Can I file taxes as a self-employed person?

Yes, without charging more. - Is it safe to utilize FreeTaxUSA?

It employs encryption and protocols that have been certified by the IRS. - Does it provide protection from audits?

With the Deluxe plan, yes. - Is a mobile app available?

No, it’s only available online. - Can I submit a modified tax return?

With the Deluxe plan, yes. - Is there customer service?

Unless you upgrade, just by email. - Can I import my return from previous year?

Yes, provided that you have utilized FreeTaxUSA before. - Who is FreeTaxUSA’s owner?

It is created by Utah-based TaxHawk, Inc.